Inventory Solutions: How Lippert Enterprises is Shaping a Greener Future

As the global need for environmentally friendly practices continues to grow, Lippert Enterprises has taken the lead in developing inventory...

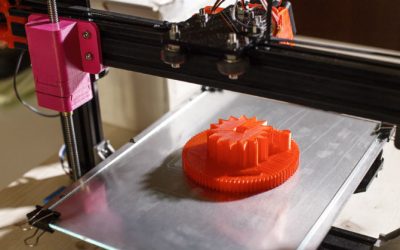

Could Additive Manufacturing Extend Equipment Life?

Additive manufacturing (also known as 3D printing) has been dropping in costs as the technology has been developing, which is resulting in more...

Autonomous Driving and the Future of Supply Chains

Technology is racing ahead and a business’s ability to survive in the future economy may be directly linked to their ability to utilize and...

Coronavirus & Heavy Equipment Supply Chain Shortages

Global supply chains are slowing due to concerns and measures taken to handle the COVID-19 (Coronavirus disease) outbreak. Numerous factories in...

Five Things to Keep in Mind When Choosing a 3PL Provider

There are many things to keep in mind when searching for a third-party logistics (3PL) provider. Choosing the correct 3PL provider can help elevate...

How Scrapping Inventory Can Damage Brand Loyalty

Common practice among the on-highway trucking, construction, mining, forestry, agriculture, crane, and heavy-machinery based industries is to scrap...

4 Ways to Identify and Manage Slow-Moving Inventory

In every industry, the goal is to continue growing. Stagnation or lack of growth is often viewed almost as badly as regressing. With growth being...

Lippert Enterprises: Adding Value to Aging Inventory

When our founder Larry Lippert began buying obsolete and slow-moving inventory from on-highway truck and heavy equipment manufacturers in 1976, he...

The Value of Centralized Distribution

Ashland County is often boasted as being the halfway point between Cleveland and Columbus, but the county has much more to be excited about....

How Lippert Enterprises Utilizes Box On Demand® to Better Serve Our Customers

Box On Demand® (BOD®) gives Lippert Enterprises the ability to create the perfect box size for any shipment. Box on Demand, owned...

What is the Difference Between a 3PL and a 4PL?

It is important to shop around when looking for a partner to meet your logistic needs. The differences between 3PLs and 4PLs can be confusing as the...